Mutual Fund

Farsight offers distribution services of IPO, Mutual Funds, Public Issues, Company Fixed Deposits, Bonds, Acquisitions and Mergers through its mammoth network of branches across India. We assure you a hassle free and pleasant transaction experience through us. Our focus is to offer integrated solutions for your investment needs of our investors.

LoginPublic Issues

Public Issues Are The Channelizing Agent Of Domestic Resources And Savings To The Corporate World. It Offers A Platform Where Investor Can Earn A Better Rate Of Return Then The Normal Market Returns. Thus, Increasing The Income, On The Other Hand, Corporate Sector Gets An Interest Free Funding Which Can Accelerate The Growth Of Economy. Public Issues Are Conducted In The Form Of Following Manner:

-

IPO (Initial Public Issues)

In This Case, Company Offer Its Shares For The Public Through Prospectus As Per The SEBI Guidelines

-

FPO (Further Public Offer)

In This Case, A Company Whose Shares Are Already Listed On Exchange Issues Further Shares To The Public With Or Without Right Issue.

-

Offers For Sale

In This Case, The Promoter Of The Company Sells The Shares To The Public From Its Existing Shareholders. Therefore, The Money Of The Sale Proceeds Goes To The Promoters And Not To The Company.

-

Right Issues

In This Case, Existing Listed Company Issues Further Shares To Its Existing Shareholders Or Their Nominee. Under The Existing Law, Public Issues Can Come Through Book Building Process Or Normal IPO System:

-

Our Services:

Farsight Helps You In Selecting The Right Public Issue Through Its Specialized Created Research Team.

- IPO Forms Can Be Deposited And Collected From Our Vast Network Of Branches Spread Across India.

- Investor Can Participate In Auction Mechanism Through Book Building Process

E-IPO:

E-IPO Is To Be Launched Shortly In India Through Broker’s Network.Under This Scheme, Investor Can Participate In The IPO Segment Just Like Secondary Market. At Farsight, We Are Fully Equipped To Meet This Challenge.

Benefits Of Public Issues:

- 1. Enlarging And Diversifying Equity Base

- 2. Enabling Cheaper Access To Capital

- 3. Increasing Exposure, Prestige, And Public Image

- 4. Attracting And Retaining Better Management And Employees Through Liquid Equity Participation

- 5. Facilitating Acquisitions (Potentially In Return For Shares Of Stock)

- 6. Creating Multiple Financing Opportunities: Equity, Convertible Debt, Cheaper Bank Loans, Etc.

For More Information:

Contact: 011-45044430, 9958700860

Mutual Funds

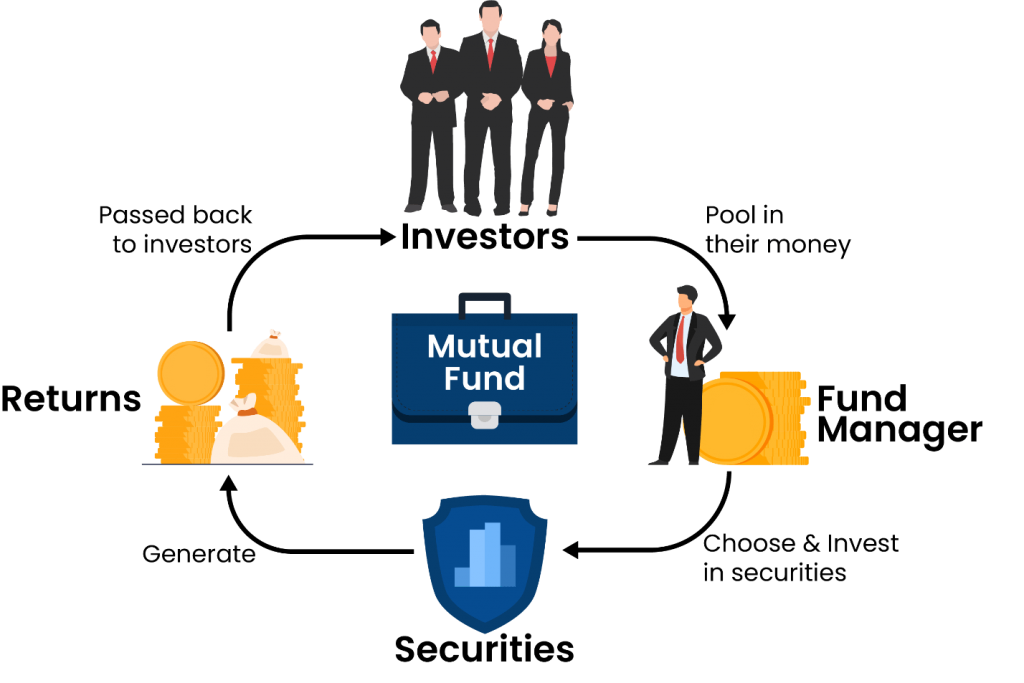

A Mutual Fund Is A Type Of Professionally-Managed Collective Investment Scheme That Pools The Savings Of A Number Of Investors Who Share A Common Financial Goal. The Money Thus Collected Is Then Invested In Capital Market Instruments Such As Shares, Debentures And Other Securities. The Income Earned Through These Investments And The Capital Appreciation Realised Are Shared By Its Unit Holders In Proportion To The Number Of Units Owned By Them. Thus A Mutual Fund Is The Most Suitable Investment For The Common Man As It Offers An Opportunity To Invest In A Diversified, Professionally Managed Basket Of Securities At A Relatively Low Cost. The Flow Chart Below Describes Broadly The Working Of A Mutual Fund:

Benefits Of Mutual Funds:

- Professional Management

- Diversification

- Convenient Administration

- Return Potential

- Low Costs

- Liquidity

- Transparency

- Flexibility

- Choice Of Schemes

- Tax Benefits

- Well Regulated

Types Of Mutual Funds & Schemes:

Wide Variety Of Mutual Fund Schemes Exist To Cater To The Needs Such As Financial Position, Risk Tolerance And Return Expectations Etc. The Table Below Gives An Overview Into The Existing Types Of Schemes In The Industry.

For More Details:

Write To Us At – Mutualfund@Farsightshares.Com

Call Us At – 011-450-44430 , 9958700860

Fixed Deposits

Company Fixed Deposit Is An Attractive Option For Regular Income With Option To Receive Monthly, Quarterly, Half Yearly & Annual Interest .IncomeFinancial Institutions And Non-Banking Finance Companies (NBFCs) Also Accept Such Deposits. Deposits Thus Mobilised Are Governed By The Companies Act Under Section 58A. These Deposits Are Unsecured, I.E., If The Company Defaults, The Investor Cannot Sell The Documents To Recover His Capital, Thus Making Them A Risky Investment Option.

Benefits Of Investing In Company Fixed Deposits:

- High Interest.

- Short-Term Deposits.

- Lock-In Period Is Only 6 Months.

- No Income Tax Is Deducted At Source If The Interest Income Is Up To Rs 5,000 In One Financial Year

- Investment Can Be Spread In More Than One Company, So That Interest From One Company Does Not Exceed Rs. 5,000

Bonds

Bonds Refer To Debt Instruments Bearing Interest On Maturity. In Simple Terms, Organizations May Borrow Funds By Issuing Debt Securities Named Bonds, Having A Fixed Maturity Period (More Than One Year) And Pay A Specified Rate Of Interest (Coupon Rate) On The Principal Amount To The Holders. Bonds Have A Maturity Period Of More Than One Year Which Differentiates It From Other Debt Securities Like Commercial Papers, Treasury Bills And Other Money Market Instruments.

Contact Us:

For New Account Opening – Mutualfund@Farsightshares.Com

Call Us At – 011-450-44430 , 9958700860